Content

- Straight-Line Depreciation Explained

- Straight-Line Depreciation FAQs

- Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

- Straight Line Depreciation Example

- Free Straight-Line Depreciation Template

- Top Free Accounting & Bookkeeping Software Apps for 2022

Fortunately, they’ll balance out in time as the so-called tax timing differences resolve themselves over the useful life of the asset. GAAP is a collection of accounting standards that set rules for how financial statements are prepared. It’s based on long-standing conventions, objectives and concepts addressing recognition, presentation, disclosure, and measurement of information. QuickBooks provides an easy guide and formula to help small business owners understand and calculate straight-line depreciation.

- Ideal for those just becoming familiar with accounting basics such as the accounting cycle, straight line depreciation is the most frequent depreciation method used by small businesses.

- Four standard types of calculationsare used to determine depreciation expenses.

- The straight line depreciation calculation should make it clear how much leeway management has in managing reported earnings in any given period.

- The sum-of-the-years’ digits method is another accelerated depreciation method that takes into account the increasing cost of an asset as it wears down or becomes obsolete.

- Straight-line amortization schedules are simple and reduce the amount of required record-keeping.

Therefore, depreciation would be higher in periods of high usage and lower in periods of low usage. This method can be used to depreciate assets where variation in usage is an important factor, such as cars based on miles driven or photocopiers on copies made.

Straight-Line Depreciation Explained

This method is regarded as the most accurate representation of devaluation, as it more closely reflects the actual wear and tear that assets go through. When using the units of production method, more resources are needed to collect enough data over long periods of time.

As buildings, tools and equipment wear out over time, they depreciate in value. Being able to calculate depreciation is crucial for writing off the cost of expensive purchases, and for doing your taxes properly. Straight-line depreciation is very commonly used by businesses, because it is fairly easy. Because the useful life and the salvage value are both based on expectation, the depreciation can be very inaccurate. Moreover, this method does not factor in loss in the short-term and the maintaining cost, which can also render many inaccuracies.

Straight-Line Depreciation FAQs

The straight-line method of depreciation is the most common method used to calculate depreciation expense. It is the simplest method because it equally distributes the depreciation expense over the life of the asset. Depreciation expense allocates the cost of a company’s use of an asset over its expected useful life. The expense is an income statement line item recognized throughout the life of the asset as a “non-cash” expense. By estimating depreciation, companies can spread the cost of an asset over several years. The straight-line depreciation method is a simple and reliable way small business owners can calculate depreciation. In most cases, the depreciation used for a specific asset depends on its nature.

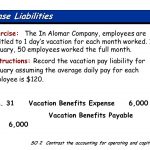

- With this cancellation, the copier’s annual depreciation expense would be $1320.

- One of the most obvious pitfalls of using this method is that the useful life calculation is based on guesswork.

- The straight-line depreciation method is a type of tax depreciation that an asset owner can elect to deduct the cost of the asset over the property’s useful life evenly.

Now, $ 1000 will be charged to the What Is Straight Line Depreciation, And Why Does It Matter? statement as a depreciation expense for eight straight years. Although all the amount is paid for the machine at the time of purchase, the expense is charged over time. We can also calculate the depreciation rate, given the annual depreciation amount and the total depreciation amount, which is the annual depreciation amount/total depreciation amount. As an example, say you bought a copy machine for your business with a cost basis of $3,500 and a salvage value of $500. To arrive at your annual depreciation deduction, you would first subtract $500 from $3,500. The result, $600, would be your annual straight-line depreciation deduction.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

However, this depreciation method isn’t always the most accurate, especially if an asset doesn’t have a set pattern of use over time. This means items like computers and tablets often depreciate much quicker in their early useful life while tapering off later on in their useful life. The declining balance method calculates more depreciation expense initially, and uses a percentage of the asset’s current book value, as opposed to its initial cost.

- When you divide the costs of these assets, you are able to have a full view of your profit margins.

- In other words, it is a systematic way of calculating depreciation deductions in equal amounts for each unit of the asset during its useful life.

- The straight line method of depreciation maintains its “straight line” by keeping the same figure from year to year.

- Though the process of calculating depreciation using the straight-line method is easy, it might be difficult for you as a small business owner to keep track of all of these assets.

- When you use the straight line method, you can spread out the cost of the assets over many years.

- She has nearly two decades of experience in the financial industry and as a financial instructor for industry professionals and individuals.

Accrual-based accounting requires a business to match the expenses it incurs with the revenues it generates each accounting period. Because a long-term asset, such as a piece of equipment, contributes toward revenues over many accounting periods, a company spreads the asset’s cost over its useful life using depreciation. This creates a depreciation expense on the income statement each accounting period equal to a portion of the asset’s cost instead of creating an expense for the entire cost all at once.

Straight Line Depreciation Method Examples

Asset Focused ETL Solution for advanced analytics and integrated, real-time asset data. Investopedia requires writers to use primary sources to support their work.

FOUR CORNERS PROPERTY TRUST, INC. Management’s Discussion and Analysis of Financial Condition and Results of Operations. (form 10-K) – Marketscreener.com

FOUR CORNERS PROPERTY TRUST, INC. Management’s Discussion and Analysis of Financial Condition and Results of Operations. (form 10-K).

Posted: Fri, 17 Feb 2023 21:57:04 GMT [source]

This loss of efficiency and the increase in repairs is not accounted for when using the straight line depreciation method. As a result, straight line depreciation is unsuitable for very expensive equipment. It is best to avoid using straight line depreciation when it is difficult to predict the useful life of an asset. Another way to calculate the depreciation of assets is the units of production method.

Straight Line Depreciation Example

https://personal-accounting.org/ the estimated salvage value of the asset from the amount at which it is recorded on the books. Analytics & Reporting Trustworthy asset and workforce data for intelligent asset operations and data-driven decisions. Enterprise Asset Management Optimize asset performance with full life-cycle visibility for data-driven asset operations. Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life.

How is straight-line depreciation calculated?

To calculate straight-line depreciation, you need to know three pieces of information about your asset: purchase price or cost, salvage value at the end of its useful life, and estimated number of years that the asset will be in service. Then you can use this formula to calculate straight-line depreciation: Depreciation = ( 1/ Estimated Useful Life) * Purchase Price or Cost

Then a depreciation amount per unit is calculated by dividing the cost of the asset minus its salvage value over the total expected units the asset will produce. Each period the depreciation per unit rate is multiplied by the actual units produced to calculate the depreciation expense. When the three years have ended, $200 will represent the carrying value on the balance sheet.