- Bengaluru scientists develop new marigold variety

Arka Shubha from IIHR has 2.8 % carotene content, sought after by the pharmaceutical sector

Generally the flowers lose their value if they get spoilt either due to rain or delay in harvest. But the new variety of marigold developed by the Hessarghatta-based Indian Institute of Horticultural Research (IIHR) are of value even if they get spoilt after full bloom as they can be used for extraction of crude carotene.

“All marigolds have carotene content that ranges up to a maximum of 1.4%. However, the Arka Shubha variety of marigold has high carotene content of 2.8% which is the highest content from plant source,” said Dr. Tejaswini P., principal scientist in the IIHR’s Division of Floriculture and Medicinal Plants, who led the team of scientists that developed this variety.

These flowers could be sold for ornamental purpose too like other marigold varieties. But there is also an option of using them for extracting crude carotene, she pointed out. As carotene is mainly used in pharmaceutical sector, there is always a high demand for it. Presently, India imports most of its carotene from other countries, including China. Dr. Tejaswini suggested that farmers consider this variety purely for extraction of carotene. However, it is better to take up the venture through farmers’ groups as it needed a large area for cultivation and investments on extraction, she pointed out. This also provides scope for exports, she said.

- Improvements in agri-credit system can revive agriculture

This budget has disappointed the farming sector. The government has increased the agricultural credit target to Rs 18 lakh crore for 2022-23 from Rs 16.5 lakh crore for the current fiscal, with an allocated subsidy of Rs 20,870 crore. The question, however, is: Is the huge credit and subsidy benefiting farmers on the ground?

- Removal of clauses which allow tea garden land sale proposed

The contentious issue of allowing sale of land under tea gardens is likely to once again come alive with the committee on revenue reforms recommending doing away with Section 6(a) and 7(a) of Himachal Pradesh Ceiling on Land Holdings Act, 1972, which allows sale of land under tea gardens.

ources said that the BJP was keen to do away with these clauses which had been incorporated by the Congress regime under pressure from the powerful tea estate owner lobby. The general feeling is that as long as these clauses remain in the Himachal Pradesh Ceiling on Land Holdings Act, 1972, the powerful tea estate owners will keep seeking permissions to allow sale of land under tea garden which is violative of the very spirit of the Himachal Pradesh Ceiling on Land Holdings Act, 1972.

‘Violative of spirit of Act’

Party leaders felt as long as these clauses remain in the HP Ceiling on Land Holdings Act, 1972, powerful tea estate owners will keep seeking permissions to allow sale of land under tea gardens, which is violative of the very spirit of the Act.

The committee on revenue reforms headed by Revenue and Irrigation and Public Health Minister Mahender Singh will be placing the recommendations of the committee before the Cabinet for approval.

The issue of allowing land sale under tea has been raised during successive Congress as well as BJP regime. Attempts by the tea garden owners lobby to get the previous Congress Government to allow sale of their property in the name of tea tourism failed to materialize.

Now fresh attempts were made during the present BJP rule to allow sale of land under tea gardens. A proposal has been moved during the BJP regime to allow land under tea gardens for setting up of a cantonment. The matter has been referred to the law department and Chief Minister Jai Ram Thakur has time and again reiterated the stand that he was not in favour of allowing land sale under tea as it was against the land ceiling Act.

Since the tea garden owners were allowed to retain excess land over and above the permissible limit under Land Ceiling Act, legally they cannot sell this land. An attempt had been made during the previous BJP regime in 2011 and by the Congress Government in 2015 and later in 2016 to find a way out by which sale of land under tea could be made permissible.

It was as per the Himachal Pradesh Ceiling of Land Holdings (Amendment) Act of 1999 that complete ban was imposed on the sale of land under tea cultivation and gave the government the power to acquire it if put to any other use. Tea cultivation is primarily confined to Kangra district and very small area of Jogindernagar contiguous to Palampur, which has some of the biggest tea estates.

- The altering patterns of Himachal apple : The Tribune India

Crimson Mouth watering and Royal Scrumptious ended up the first apple sorts launched in Himachal Pradesh by Samuel Stokes a couple of century again once more. From these standard crops that may develop as much as 30 to 35 ft and yield 40 to 60 bins of their key, the changeover to the newest spur and substantial-colour pressure sorts, which is now underway, may get bigger fee this 12 months. The induce can be the insufficient snowfall within the reduce and heart apple belts, even with ample snowfall at higher altitudes, most important to the traditional varieties performing beneath par at very low and heart elevations.

For greater than a ten years now, snow has been receding from the diminished and center apple belts. Though an elevation of 4,500 toes to five,500 ft is categorised because the decrease belt, 5,500 to 7,000 ft is the middle belt, and beforehand talked about that, the numerous belt. Earlier than, when it snowed within the higher reaches, these elevations would obtain important snowfall too. It’s no extra time the scenario. “Over the previous 10 years or so, a lower has been seen in snowfall in small and heart heights. Native local weather change and meteorological facets are the large motives driving the receding snowfall,” says Surender Paul, Director, Indian Meteorological Division, Himachal Pradesh.

Within the absence of plentiful snow, the ‘chilling hours’, about 1,000, important by the traditional apple varieties are difficult to satisfy up with. Additionally, the absorption of vitamins by the soil and inevitably by the plant can be impaired. As a consequence, the traditional sorts are struggling to develop good high quality fruit at these heights. This has compelled growers to alter to modern varieties that require comparatively considerably considerably much less ‘chilling hours’.

“We obtained simply 3-4 inches of snow this yr. The traditional ‘scrumptious’ varieties should not acting at decrease heights, and individuals are dashing within the course of the most recent sorts,” states Pratap Chauhan, an orchardist from Kotkhai, who has an orchard at an elevation of 5,000 ft. “Not a number of are considering the traditional varieties for elevations so much lower than 7,000 toes,” he provides.

When in comparison with the brand new sorts, nonetheless, the lifespan of normal sorts may be very in depth. There are bushes which can be nearly 80 years outdated.

Horticulture specialist SP Bhardwaj thinks the shift to newer sorts is the should have of the hour. “It’s an sensible remaining choice. At these heights, the traditional crops are struggling to create the fruit with nice color and dimension. Then again, the newer variations don’t have any such issues and are fetching significantly better costs,” says Bhardwaj. “Additionally, every kind bear from genetic degradation quickly after a specific interval of time, high to a drop within the good high quality of fruit. So, it’s important that apple growers go to probably the most present sorts.”

The shift, whereas desired, is easier talked about than carried out. The enter worth is so much much more, particularly on the outset, in newer sorts. The funding choice options expenditure on irrigation, linked building and hail nets. Versus the widespread sorts, the brand new sorts demand extra care. “It’s uncomplicated to swap a handful of vegetation, however when you must should swap all the orchard, significantly if 1 is switching to rootstocks, the fee is fairly larger,” suggests Dikshit Chauhan, an orchardist from Jubbal.

The governing administration does give some assist within the number of subsidies on crops, anti-hail web, irrigation, etcetera, however the funds seems to be to run fast. Particularly areas, individuals have been ready for internet subsidy for a decade.

Importing points

While the farmers may need noticed a approach to take care of the switching weather conditions, they’re struggling to maintain afloat amid a deluge of imported apples, significantly from Iran. Because of the numerous arrival of Iranian apple this yr, there isn’t any demand from clients for the neighborhood apples that had been being saved all through the functioning interval (when the harvest is nonetheless on, or has simply accomplished). “Each farmers and arhtiyas have skilled monumental losses on saved apple this yr. The market place is flooded with cheap Iranian apple and our individuals at the moment are compelled to promote their ship at throwaway promoting costs,” states NS Chaudhary, president of the situation arhtiya sangh. “This can have an opposed have an effect on on the up coming time. The arhtiyas, struggling losses, will battle to clear funds and each of these growers and merchants might be scared to retail outlet the fruit following yr. And if the general generate arrives to the market place at one time, the charges will crash.”

Although apples are imported from a variety of countries all over the world, the import from Iran is notably troublesome. “The issue with the Iranian apple is the amount and the worth tag at which it’s attaining the Indian business. It’s supplied for as minimal as Rs40-60 for every kg,” suggests Lokender Bisht, an apple grower from Rohru.

Beforehand, it was routed by the use of Afghanistan-Pakistan (beneath SAFTA) to steer clear of import responsibility. With the regime alter in Afghanistan, the by-highway arrival has drastically dropped. Now, it’s coming on account of the ocean however it’s nonetheless out there at reasonably priced charges merely due to the rampant underneath-invoicing and minimal expense of technology in Iran, Bisht offers. The growers sense that doubling the import responsibility from the current 50 per cent would give some elbow house to the neighborhood apple.

The at any time-escalating cost of manufacturing has pushed the close by apple right into a weak scenario versus the Iranian apple. As per the robust estimates of growers, the for every kg price of creation has attained throughout Rs30. “An apple field is fetching way more or significantly much less the exact same price ticket as in 2010. The enter price, nonetheless, has larger manifold. The expense of pesticides, pesticides, fertilisers and packaging product has seen a pointy rise, the subsidies are shrinking or closing down fully, the transportation and labour bills have additionally elevated noticeably. All this has led to an enormous decrease in revenue margins,” claims Dikshit Chauhan.

And remaining however not the minimal, the growers assume the advertising of the fruit desires a big thrust. “The authorities should acquire a market the place we are able to export fruit. Some initiatives ended up created final 12 months to check out {the marketplace} within the Heart East these need to keep it up,” states Harish Chauhan, president of the Fruit, Vegetable and Flower Growers Affiliation. “There’s an pressing need to established up processing crops and tiny managed setting (CA) retail retailer providers within the apple belt. This is able to go a really good distance in conserving the growers from present market forces and ensuring a remunerative fee for his or her make,” he offers.

Rs 5,000-CRORE TRADE

The apple sector in Himachal is price Rs5,000 crore. By way of the general sector share, the state produces 20-25% fruit, though Kashmir tops the report with a present market share of 70-75%. The full apple output is all-around 20-25 lakh MT Kashmir makes 14-18 lakh MT and HP 4-7 lakh MT.

How Indian apple is distinctive

Himachal apple is sweeter, juicier and tastier than imported apple, which arrives into {the marketplace} six months quickly after harvest. In Kashmir, Delicious and Kullu Delicious are the main conventional variations, with superb shelf day by day life, sweetness.

The Manner ahead: Diversify

The plan of diversifying into stone fruits, predominantly plum, is gaining foothold within the apple belts. “Many women and men are diversifying their fruit basket, and planting plums, peaches, cherries and apricots,” says Deepak Singha, founding father of the Plum Growers Discussion board. When in comparison with apple, he provides, the enter prices and the prevalence and administration of sicknesses is considerably so much much less in stone fruits.

Planting time

Plantation time is from December to March. The variations changing into desired at diminished altitudes are Gallas, King Rot, Adams, Zad One, Jeromine Crimson Velox, Oregon Spur 2 Early Pink One explicit in center heights and Royal, Ace and Fuji at larger altitudes.

- India gets first herbicide-tolerant & non-GM rice varieties

The varieties — Pusa Basmati 1979 and Pusa Basmati 1985 — contain a mutated acetolactate synthase (ALS) gene making it possible for farmers to spray Imazethapyr, a broad-spectrum herbicide, to control weeds.

The Indian Agricultural Research Institute (IARI) has developed the country’s first-ever non-GM (genetically modified) herbicide-tolerant rice varieties that can be directly seeded and significantly save water and labour compared to conventional transplanting.

The varieties — Pusa Basmati 1979 and Pusa Basmati 1985 — contain a mutated acetolactate synthase (ALS) gene making it possible for farmers to spray Imazethapyr, a broad-spectrum herbicide, to control weeds. This dispenses with the need to prepare nurseries where paddy seeds are first raised into young plants, before being uprooted and replanted 25-35 days later in the main field.

The two new varieties are scheduled to be officially released by Prime Minister Narendra Modi on Tuesday.

Paddy transplantation is both labour- and water-intensive. The field where the seedlings are transplanted has to be “puddled” or tilled in standing water. For the first three weeks or so after transplanting, the plants are irrigated almost daily to maintain a water depth of 4-5 cm. Farmers continue giving water every two-three days even for the next four-five weeks when the crop is in tillering (stem development) stage.

“Water is a natural herbicide that takes care of weeds in the paddy crop’s early-growth period. The new varieties simply replace water with Imazethapyr and there’s no need for nursery, puddling, transplanting and flooding of fields. You can sow paddy directly, just like wheat,” said A K Singh, director of IARI.

Imazethapyr, effective against a range of broadleaf, grassy and sedge weeds, can’t be used on normal paddy, as the chemical does not distinguish between the crop and the invasive plants. The ALS gene in rice codes for an enzyme (protein) that synthesises amino acids for crop growth and development. The herbicide sprayed on normal rice plants binds itself to the ALS enzymes, inhibiting their production of amino acids.

The new basmati varieties contain an ALS gene whose DNA sequence has been altered using ethyl methanesulfonate, a chemical mutant. As a result, the ALS enzymes no longer have binding sites for Imazethapyr and amino acid synthesis isn’t inhibited. The plants can also now “tolerate” application of the herbicide, and hence it kills only the weeds.

“This is herbicide-tolerance through mutation breeding, not GM. There isn’t any foreign gene here,” Singh pointed out.

Both Pusa Basmati 1979 and 1985 have been bred by crossing existing popular varieties — Pusa 1121 and Pusa 1509, respectively — with ‘Robin’. The latter is a mutant line derived from Nagina 22, an upland drought-tolerant rice variety. The mutant was identified for Imazethapyr-tolerance by S Robin, a rice breeder from Tamil Nadu Agricultural University in Coimbatore.

Farmers in Punjab and Haryana are already adopting direct seeding of rice (DSR) in response to labour shortages and depleting water tables. This year alone, roughly 6 lakh of the total 44.3 lakh hectares area under paddy in the two states has come under DSR.

DSR cultivation is currently based on two herbicides, Pendimethalin (applied within 72 hours of sowing) and Bispyribac-sodium (after 18-20 days). As Singh pointed out, “These are costlier than Imazethapyr (Rs 1,500 versus Rs 300/acre). Imazethapyr, moreover, has a wider weed-control range and is safer, as the ALS gene isn’t present in humans and mammals. Even in the herbicide-tolerant rice, the chemical will target only the weeds.”

Transplantation in paddy typically requires about 30 irrigations, each consuming some 5 hectare-cm of water (one hectare-cm equals 100,000 litres). Puddling alone takes up about 15 hectare-cm. In all, DSR is estimated to need 30 per cent less water, save Rs 3,000 per acre in transplantation labour charges, and also 10-15 days’ time due to no nursery preparation.

- Canada, India need common framework on agri trade: Canada India Business Council’s Thomas

Canada seeks closure on early progress trade pact before FTA concludes, says the council’s president

Canada and India should draft a common framework on agriculture-related issues for smooth business in agri items, said Victor T. Thomas, president of the Canada India Business Council. In an exclusive interview, Mr Thomas highlighted that Canada was looking forward to firm up an Early Progress Trade Agreement (EPTA) before the final conclusion of the Comprehensive Free Trade Agreement.

“On the agricultural side, our standards are very high. We are the sixth-largest exporter of agricultural products. The trouble has been that there were inconsistencies on both sides. The agreed upon framework to trade in agriculture was missing for both sides. Agriculture is one of our strongest pieces and a lot can be done in this sector. Canada’s role can be crucial in ensuring food security in India,” said Mr. Thomas providing his take on resolving the difficulties in the negotiation of the agriculture sector.

India and Canada restarted negotiations over the Free Trade Agreement earlier this week when Ottawa’s Trade Minister Mary Ng was hosted by Commerce and Industry Minister Piyush Goyal. Speaking at the event, Mr. Goyal had highlighted issues regarding agriculture that are expected to be addressed during the negotiation over the coming months. Mr. Thomas said Canada was interested in a range of items such as jewellery, textiles and spices from India that are expected to be part of the trade deal.

Canada and India began negotiation on the FTA a decade ago but the talks were stalled in the backdrop of political shifts on both sides. Mr. Thomas said that Canada sensed that possibilities for the trade deal had opened up as India had fast-pedalled similar deals with countries like Australia, the UAE, and the United Kingdom, adding, “There were times that were less than ideal. Things are back on track. Both countries want to make it work.”

Negotiations for the trade deal that were started by the two Ministers are likely to include phytosanitary measures, goods and services, rules of origin and other such issues that were also part of the recent trade agreement with the United Arab Emirates.

Mr. Thomas highlighted commonalities between Indian and Canadian democratic traditions and said that Canada should do more trade with India in comparison with other big economies that do not follow democratic principles. “We know how important democracy is and there is a need to tie in our democratic partners. We have common laws and complementary economies,” said Mr. Thomas, who also highlighted the key role that uranium from Canada could play in giving shape to India’s aspirations for a pollution-free energy sector.

“When you look at the goals set by the Indian government in terms of carbon reduction, uranium can play a major role over the next 20-25 years,” said Mr Thomas.

- Short film on farm woes tugs at heartstrings

Last monsoon, two farmers had been washed away in the flood waters while trying to save their crops in Solapur district of Maharashtra. The same district has witnessed a high suicide rate among farmers.

Heart-rending stories of farmers’ struggles were put together in a short film by Vishal Vijay Garad, a lecturer and son of a farmer couple. He owns five acres of land in Pangri village of Solapur district, but his parents Vijay and Mohini are active farmers who grow jowar, wheat and soyabean. Mr Garad has heard and seen innumerable stories of farmers incurring heavy losses due to unseasonal or incessant rain. He blames the erratic rain pattern on climate change taking place due to wrong policies adopted by successive governments. About 10 farmers in Solapur have died by suicide in the past year, he claims.

With distressing stories playing on his mind, Mr Garad decided to write, direct and act in a short film titled ‘Buchad’ which means all harvested crops piled up at one place. In the film, he has played the character of Bhim Pawar, a soyabean farmer. His crop is almost ready for harvesting, but is washed away due to heavy rains following floods. While trying to save the crop, Bhim Pawar also gets washed away. The film ends with him floating in water, firmly gripping the soyabean crop in hand.

There was not a single dry eye as the last scene of Buchad played out during the Jai Chandiram Memorial 3rd National Community Media Film Festival at Krishi Vignan Kendra run by Deccan Development Society at Didgi near Zaheerabad on Saturday. Not surprising, it won the best short film award.

Chandrika, a young girl who was part of audience, broke down during the film and said her parents too had suffered due to crop loss.

Speaking to The Hindu , Mr Garad said, “Wrong policies of successive governments have resulted in climate change and farmers are the first casualty. I made this film to explain the pathetic conditions of farmers.”

- Hatsun to set up dairies, solar power plant

Expansion to serve eastern region

Dairy-product maker Hatsun Agro Product Ltd. (HAPL) is planning to set up two dairies in the eastern region as part of its expansion plans, said a top official.

“Today, our board has given approval for setting up two dairy plants,” said H. Ramachandran, CFO.

“Details such as size of the plant, total investment and the time frame of their execution will be announced in a month’s time. We have to get sizeable chunk of land in these places to set up the plants.”

The ₹5,317-crore firm has a strong presence in the South and in Maharashtra.

“The new dairies are likely to come up north of Andhra Pradesh and in Odisha, at a distance of about 150 km. This would enable us to serve the eastern region up to Kolkata,” he said.

HAPL’s board also approved the signing of a share purchase agreement with solar power company Swelect Sun Energy Pvt. Ltd.

The two companies would set up a 16 MW solar power project.

“Basically, this agreement is for the purchase of solar power for captive use in Tamil Nadu,” he said.

- Bumper potato crop brings cheer to Doaba farmers

In a big relief to Doaba farmers, favourable weather conditions and lesser rain have led to a bumper potato crop this year, fetching them a price of Rs 7.5 to Rs 8 per kg in the market.

Harvesting is over and farmers are now engaged in packaging. While some crop has gone to the states of Karnataka and West Bengal, the remaining is being used in Punjab itself.

For the time being, farmers intend to sell out only 10-15 per cent of the crop in the market. The remaining will be kept in cold stores and is likely to be taken out in September when it will fetch them even a better price.

Horticulture Development Officer Paramjit Singh said there was an increase of 1.5 lakh metric tonne of production this year. “While the last year’s production of potato in Punjab was 28 lakh metric tonne, this time it has touched 29.5 lakh metric tonne. There has been a 2 per cent increase in the area under potato cultivation this year, with the total being 1.07 lakh hectare,” he said.

Phillaur-based potato farmer Jagat Gill Thamanwal said, “Owing to favourable weather conditions and no disease outbreak, my production per hectare went up 10 per cent. I cultivate potato on 100 acres of land and my crop has gone to the markets of Gujarat,

UP and West Bengal.”

A member of the Jalandhar Potato Growers’ Association, who uses aeroponics technique of growing potatoes, he added, “Though we got a reasonable price this time, I feel that even the cost of production has gone up.”

Harjinder Singh, a farmer from Kapurthala, said, “I had grown pukhraj potato on 95 acres. I got a production of 150 quintal per acre this time, which is quite good. I am also happy with the price of Rs 7.5 to Rs 8 per kg that my crop is fetching in mandis.”

- Make governance lean & mean

THE key challenge to governance in a modern State is the handling of complexity, which also changes form and colour with rapidity. Complexity arises from a variety of sources. There is the impact of technology, the globalisation of our economies, the disruptions in our societies and the unfamiliar pressures on our individual psyches. The familiar anchors on which governance is based are no longer stable. The structures of a traditional State, its institutions, processes and capacities are unable to deal with complexity. The agility required to keep abreast of change is also missing. The State may try to cope through recourse to some new instruments enabled by modern technology, such as introducing digital delivery of State support to citizens, promoting digital payments and digitising government records to facilitate access to government services. They are welcome but remain at the margins of governance. The basic structure of the Indian State and its mechanisms of governance have remained mostly the same as inherited from the British colonial administration in 1947. The State consists of an aggregation of vertical hierarchies, which sometimes coordinate but rarely collaborate.

Most of the challenges countries confront today are cross-domain in character. State intervention through one hierarchy may either reinforce or even cancel out an intervention in another domain through feedback loops. For example, in order to deliver food security, the State may encourage the use of chemical fertilisers and pesticides. But this has adverse health consequences for the farming population which is constantly exposed to their toxic after-effects. The gain in one domain may result in losses in another. The current State structure has no mechanism to deal with such feedback loops. These examples can be multiplied.

A few critical governance reforms for a modern State are vital. One, decision-making must be based on accurate data, its careful analysis and evaluating outcomes against objectives. The professional reputation and credibility of India’s statistical agencies has been diminished. Even if data is reliable, it is not made available in a timely fashion. This may serve some short-term political purpose but does serious damage to effective policy-making.

While there is a considerable data flow on economic issues, there is neglect of social sectors, of resource endowments and use and most spheres of governmental activity. Any policy decision requires getting the facts right. This, in turn, requires the setting up of a first-rate data collection, collation and analysis system, which is free of governmental interference. Data collected through such a system and data generated by government ministries and agencies should be treated as public goods to which the general public must have full and easy access. National security exceptions should be limited and justified if they are adduced. This would enable public scrutiny. Several ministries and government agencies routinely label data generated by them as confidential. On occasion, one has found that this label is used to hide either sloppy or even non-existent data collection by them.

Data collection and analysis are critical in evaluating the efficacy of government schemes, such as the National Rural Employment Guarantee scheme, the Food Security Bill, the Rural Health Mission and the more recent and laudable initiatives, such as the eradication of open defecation. These are all well-intentioned and involve large financial outlays. However, there are few in-depth and regular surveys to gauge their impact, whether their administrative and regulatory requirements have been met optimally and the ways in which their effectiveness may be improved. In India, the practice is to first launch a scheme and then go about working on its institutional and regulatory requirements, through essentially a hit-and-miss process. This is a huge waste.

Two, policy decisions should be careful not to create an ‘arbitrage economy’, which distorts risks and returns in economic activity. Before imposing any control on prices or on any economic activity, the State must consider whether it has the capacity and the legal and regulatory instruments available to achieve the objectives of the control. If businessmen find that they can garner greater profits, with fewer risks, through preferential pricing decisions or subsidised land and other resource allocations by the government, there will be little incentive to take investment decisions that require entrepreneurial ability and risk-taking. Such controls or subsidies must have an early sunset clause since they tend to become virtually permanent and give rise to strong vested interests. The government has been unable to introduce much-needed reform in agriculture as a result of such vested interests. Despite the fact that the current cropping pattern in Punjab, Haryana and western UP has led to mountains of rotting grain in government warehouses and out in the open, it is proving politically difficult to do away with the MSP regime which has given rise to it.

Three, effective governance must be based on setting high standards and pursuing excellence in every sphere of government activity. The pursuit of excellence should not be sacrificed for reasons of social equity; the latter should be ensured through appropriate affirmative policies. Egalitarianism should aim at raising standards to the highest level achievable rather than seeking the lowest common denominator. This is particularly important in an era of complexity, of rapid technological change and the rising demand for professionally qualified and well-trained personnel in virtually every domain of government.

Let us hope that in this new year, these more fundamental questions are at least acknowledged so that we may begin to adapt our governance system to the complex challenges confronting us.

- Reorient govt policies to end stubble burning

The long-term solution lies in diversifying away from paddy, which has led to a precipitous decline in the water table across Punjab and adds a significant burden to the exchequer in the form of electricity subsidies. Farmers who have experimented with diversification in the past often switch back to paddy on account of poor market prices. The government must ensure that farmers who diversify away from paddy are protected from price volatility of the free market.

Kurinji LS & Srish Prakash

THE first fortnight of November witnessed a surge in cases of crop residue burning across Punjab. The number of farm fires in the state jumped from just over 200 in September to over 16,000 in October and a staggering 76,000 by November 20. This spike, coupled with unfavourable meteorological conditions such as northwest winds, low wind speeds, declining temperatures and emissions from local sources, has deteriorated air quality in North India, including Punjab, to alarming levels.

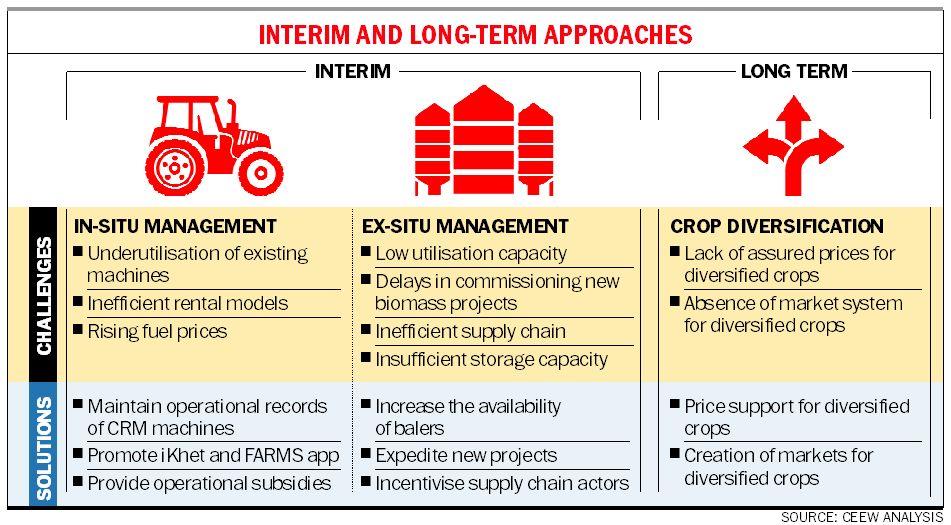

In the past few years, Central and state governments have taken several measures to discourage farmers from burning stubble. These range from the promotion of in-situ and ex-situ crop residue management to an outright ban on burning. In-situ management involves incorporating the residue back into the soil using Crop Residue Management (CRM) machines or through composting techniques. In ex-situ management, the residue is collected and supplied for other applications such as boiler fuel in industries and power plants, and in packaging material, among others. However, it is evident that these measures have failed to dissuade farmers from burning residue.

As the current kharif harvest season comes to an end, it is important that our policy-makers engage in a rigorous analysis of the reasons that kept the fields on fire yet again. While some of the measures taken by the Central and state governments are laudable, there are shortcomings within the existing solutions. Overcoming these challenges requires a combination of technologies and incentives. So, what could be done to improve the efficacy of the existing policies?

Ensure that existing CRM machines are operated at their maximum capacity. Financial assistance from the Union government through the ‘Promotion of Agricultural Mechanisation for In-Situ Management of Crop Residue’ scheme has led to a spurt in the availability of in-situ machines such as Happy and Super Seeders in Punjab. These are tractor-towed machines that plough the stubble into the ground and sow wheat. A recent study by the Council on Energy, Environment and Water (CEEW) indicates that the current stock of over 13,000 Happy and 17,000 Super Seeders can cover 66 per cent of the 25.81 lakh hectares under non-basmati paddy this year. However, most of these machines are likely to remain underutilised due to farmers’ unproven fears about the yield of wheat sown by these seeders and inefficient rental models. The deployment of these machines also faces logistic barriers. Two-thirds of these machines are owned by custom hiring centres (CHCs) and renting them from a CHC is an economically viable option for the 33 per cent small and marginal farmers of Punjab. By enhancing the subsidy on these machines to 80 per cent for farmer groups compared to 50 per cent available for individuals, the scheme also nudges buyers to approach CHCs. But these machines are unable to cover the designated geography due to inefficient logistic management, lack of manpower and delays in transportation. Farmers are often unsure of the timely arrival of the rented machines. This pushes them to either own a CRM machine or resort to burning the stubble. At present, there is no data on the deployment and usage of these machines; this makes it difficult to analyse their adoption rate. The government should mandate CHCs to maintain the operational record of these machines. This should include the name, contact details, landholding and rental dates of the farmers who rent these machines.

The state should use simple yet reliable technologies to popularise CHCs. The government’s emphasis has been on mobile applications such as FARMS and Ikhet to improve rental access to these machines. However, with the Central government’s FARMS app being used just 21 times between September 2019 and September 2021 in Punjab, there is little evidence that such platforms work. During our interactions with the farming community in the state, we noted limited awareness about these apps. We suggest that the government should launch campaigns to popularise these apps and familiarise farmers with their interface. Further, the state government must broadcast the contact details of CHCs at the block level via text messages and WhatsApp which have much higher acceptance.

The state should look at the prospect of providing operational subsidies to small and marginal farmers. The steep rise (60 per cent since March 2020) in diesel prices has increased the operational cost of these CRM machines by up to 8 per cent this year. High fuel prices are proving to be a hurdle to the sustained use of these machines. Given the state’s inability to alter fuel prices substantially, we suggest direct benefit transfers to farmers who use these machines to compensate for the rising fuel prices. The state can utilise its network of panchayats, patwaris, agricultural officers and specially designated officers to identify and compensate users of these machines.

The state should ensure that ex-situ utilisation capacity is increased swiftly. Ex-situ crop residue management is highly acceptable among farmers as it does not alter their farmland and provides scope for additional income. The state has 11 biomass-based power plants with a capacity to manage 0.88 million tonnes of residue annually. This amounts to less than 6 per cent of the residue generated this year. The state was to commission two biomass power plants and two bio-CNG plants in the current year, and one bio-ethanol and four bio-CNG plants in late 2022 and 2023. These projects will increase the crop residue utilisation capacity to around 1.5 million tonnes per annum. However, these projects have faced delays. Ex-situ management also suffers from the lack of balers, storage capacity, supply chain actors, and skilled workforce to aggregate, store and supply the residue efficiently. The state needs to expedite the construction of new ex-situ facilities and incentivise such projects through various forms of subsidies to protect their competitiveness with other sources of energy.

The state government must provide matching incentives for diversifying away from the paddy-wheat monoculture. The long-term solution lies in diversifying away from paddy, which has led to a precipitous decline in the water table across the state and adds a significant burden to the exchequer in the form of electricity subsidies. Our interaction with farmers indicates that current price signals, marketing and procurement for crops other than paddy are not lucrative enough to support a transition away from paddy. Farmers who have experimented with diversification in the past often switch back to paddy on account of poor market prices. The government must ensure that farmers who diversify away from paddy are protected from the price volatility of the free market. This could take the form of input subsidies, Minimum Support Price or an insurance-like scheme.

Paddy residue burning has been a decades-old practice and the inadequacy of existing policies needs to be addressed swiftly. This issue needs collective action from various stakeholders within and beyond Punjab. Instead of breathing a sigh of relief after the conclusion of stubble burning this year, we must reflect on the learnings and prepare for the next one.

Kurinji is a Programme Associate and Prakash is a Consultant at the Council on Energy, Environment and Water

- Goal of doubling farmers’ income still elusive

Farmers’ income can be enhanced by incentivising them to diversify away from the rice-wheat monoculture toward high-value crops; improving the accuracy of weather predictions; providing them with ‘weather-based crop insurance’ (extreme temperature, flooding, drought, hailstorm); and enhancing their capacity to form cooperatives, such as Farmer Producer Organisations.

Manjit S. Kang

OF all enterprises, agriculture affects every human being: no food, no life! Jawaharlal Nehru said at the time of Independence, “Everything else can wait but not agriculture.” Farmers are rightly referred to as annadata. Thus, agriculture should receive the highest priority. This should be particularly true in India, as the livelihoods of more than half of the country’s population depend, directly or indirectly, on agriculture. Agriculture also supports allied industries by providing raw material.

Farmers’ income can be enhanced by incentivising them to diversify away from the rice-wheat monoculture toward high-value crops; improving the accuracy of weather predictions; providing them with ‘weather-based crop insurance’ (extreme temperature, flooding, drought, hailstorm); and enhancing their capacity to form cooperatives, such as Farmer Producer Organisations. There is a need to set up ‘sustainable agriculture centres’ at key state agri universities.

There are not many positive aspects in the 2022-23 Budget as far as agriculture is concerned. The overall allocation for agriculture is up by less than 5% (Rs 1.33 lakh crore against Rs 1.27 lakh crore in 2021-22). The outlay for strengthening agricultural infrastructure has been increased to Rs 500 crore from Rs 200 crore in 2021-22. However, this was only 56% of the allocation for agricultural infrastructure in 2020-21.

The allocation for the Rashtriya Krishi Vikas Yojana (RKVY) saw an increase of about 18%: Rs 10,433 crore against Rs 8,852 crore in 2021-22. Some of the projects that the RKVY could strengthen are: ‘More crop per drop’ (water-use efficiency); Parampragat Krishi Vikas Yojana (PKVY; natural farming in North-East India); soil health/fertility; rainfed area development and climate change; agricultural mechanisation and management of crop residue.

The government will make it mandatory for thermal power plants to use biomass pellets as 5% to 7% of their fuel mix (with coal) to generate electricity. This practice should reduce air pollution and possibly give farmers extra income.

The PM-KISAN programme saw a 0.74% increase in allocation — Rs 68,000 crore against Rs 67,500 crore in the previous year.

Some important programmes that saw reduction in allocation in the 2022-23 Budget are:

(a) Pradhan Mantri Bima Yojana (Crop insurance): Rs 15,500 crore against Rs 15,990 crore in 2021-22.

(b) Minimum Support Price (MSP): Rs 2.37 lakh crore in direct procurement payments compared to Rs 2.48 lakh crore in 2021-22. The Finance Minister said 1.63 crore farmers benefited from the procurement of 12.1 crore tonnes of paddy and wheat at MSP in 2021-22 compared with 1.97 farmers (12.9 crore tonnes of paddy and wheat procured) in 2020-21.

(c) Related to MSP-based procurement of pulses and oilseeds, Market Intervention Scheme-Price Support Scheme got a reduced allocation: Rs 1,500 crore vs Rs 3,960 crore in the revised estimate for 2021-22. In addition, the Pradhan Mantri Annadata Aay Sanrakshan Abhiyan received only Rs 1 crore compared with Rs 400 crore in 2021-22.

(d) Food and nutritional security: Rs 1,395 crore against Rs 1,540 crore in 2021-22.

(e) Other than encouraging organic farming in the North-East region (Rs 198 crore allocated), there is no allocation for PKVY, even though PM Modi had urged in December 2021 that natural farming be promoted.

(g) Fertiliser subsidy has been reduced. Urea subsidy is down by 17% and N-P-K fertiliser subsidy has been reduced by 35% compared with the revised estimates for 2021-22.

Some oddities in the Budget speech were noted. For example, states and union territories will be asked to revise the syllabi of state agricultural universities (SAUs) to emphasise organic farming, value addition, ‘Zero-budget natural farming’, etc. Organic farming cannot be popularised in the country by simply changing the curricula of the SAUs. It is the farmers who need incentives to adopt organic farming. According to a 2019 survey, India’s area under organic farming was only 36.7 lakh hectares (5.1% of the total global area under organic farming). Small gains are possible, but this situation is not expected to change substantially even after five years. Farmers will have to be compensated for reduced productivity from organic farming, at least in the initial years.

The Finance Minister did not address the issue of ‘Doubling Farmers’ Income’ (DFI) by 2022. The Committee on DFI had produced 14 volumes totalling 3,156 single-spaced pages full of bureaucratic jargon. The committee listed five points as essential ‘pillars’ for doubling farmers’ income and sustaining a steady income growth in the long run: Increasing productivity as a route to higher production; reduced cost of production/cultivation; optimal monetisation of the produce; sustainable production technology; risk negotiation all along the agricultural value chain.

The committee had also proposed to develop a National Farmers’ Database partly to double farmers’ income. However, according to a survey conducted by the National Sample Survey Office, between July 2017 and June 2018, just 4.4% rural households had a computer against 14.4% in an urban area. Only 14.9% rural households had access to the Internet against 42% households in urban areas. The committee failed to recognise this fact. No wonder the goal of doubling farmers’ income remains elusive. The fact is that in 2015-16, when the idea of doubling farmers’ income was conceived, the base income per household was about Rs 8,060 per month. That income, after accounting for inflation, should have been Rs 21,150 per month in 2022, which is not the case.

Farmers’ income can be enhanced by: Incentivising them to diversify away from the rice-wheat monoculture toward high-value crops; improving the accuracy of weather predictions; providing them with ‘weather-based crop insurance’ (extreme temperature, flooding, drought, hailstorm); enhancing their capacity to form cooperatives, such as Farmer Producer Organisations (FPOs).

If organic farming and conservation agriculture are to be promoted, underground water depletion is to be arrested, environment is to be preserved, and climate-resilient, highly productive crop varieties are to be developed, ‘sustainable agriculture centres’ should be established at key SAUs.

While preparing the annual Budget, the government should consult heads of SAUs by inviting them to a pre-Budget meeting. Farmers’ representatives and progressive farmers should be consulted too because, after all, farmers are the ones who know the ground realities. They are the ones who have brought India out of severe food deficiency to make it a food-secure nation.

Major announcements

Procurement of wheat in Rabi 2021-22 and the estimated procurement of paddy in Kharif 2021-22 will cover 1,208 lakh metric tonnes of wheat and paddy from 163 lakh farmers, and Rs2.37 lakh crore direct payment of MSP value to their accounts.

Chemical-free natural farming will be promoted throughout the country, with a focus on farmers’ lands in 5-km-wide corridors along the Ganga, at the first stage.

Use of Kisan drones will be promoted for crop assessment, digitisation of land records, spraying of insecticides, and nutrients.

The author is former V-C, PAU, Ludhiana

- Union Budget: Encourage diversification, reduce subsidy bill

WITH the Union Budget set to be presented, it’s time to delve into key themes pertaining to the agriculture sector. The total Gross Value Added (GVA) of the Indian economy at basic prices has grown from 2011-12 to 2019-20 from about Rs 82.2 lakh crore to Rs 132.7 lakh crore at a Compound Annual Growth Rate (CAGR) of 6.35%. This has outpaced the CAGR of 3.44% with regard to GVA basic prices for the agriculture, forestry and fishing sector, which grew from Rs 15 lakh crore to Rs 19.7 lakh crore in the said period, implying a reduction in the total share from 18.53% to 14.83%. The GVA is arrived at by deducting the component of intermediate consumption from output. Interestingly, the GVA-to-output ratio for the agriculture, forestry and fishing sector is highest at 78.3. Thus, this sector exhibits the highest potential in terms of contribution to the total marginal output of the economy.

Incentives to shift towards Zero Budget Natural Farming and more of pulses, oilseeds, agroforestry and horticulture cultivation and food processing activities shall, in turn, lead to transition to market-led activity and reduction in the subsidy burden, stronger linkages with the industry, boosting the value chain and leaving more room for investments in agriculture. In order to boost capital investments, launch of the Agriculture Infrastructure Fund with a corpus of Rs1 lakh crore is welcome.

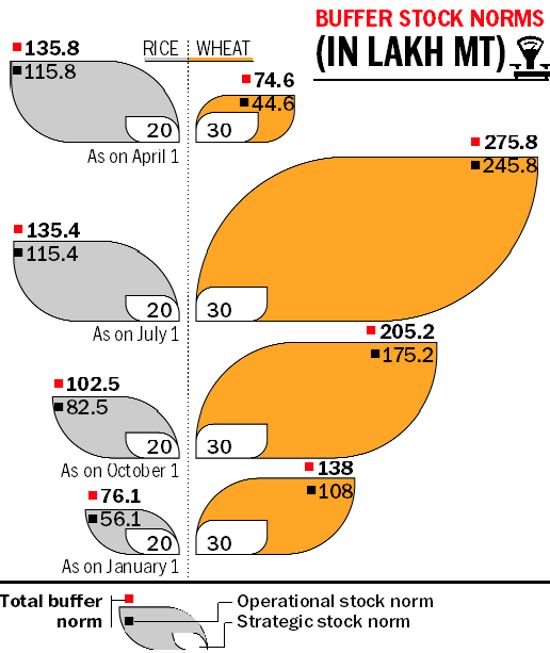

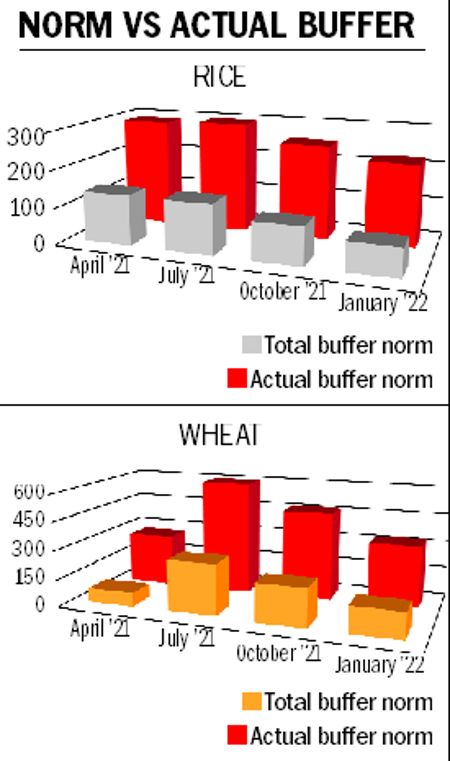

Firstly, let us look at food subsidy and fertiliser subsidy. Their allocation (budget estimates or BE) for 2021-22 is Rs 2,42,836 crore and Rs 79,530 crore, respectively. This takes the allocation for major subsidies to Rs 3,35,361 crore — food subsidy (72%) fertiliser subsidy (24%) and petroleum subsidy (4%). Food subsidy is provided to meet the difference between economic cost of foodgrains and their sales realisation at the Central Issue Price fixed with regard to the National Food Security Act and other welfare schemes. The buffer stock norms for rice and wheat maintained by the Food Corporation of India (FCI) comprise two components — the operational stock and the strategic stock. An examination of the actual stock positions for all quarters over the past four years reveal that the buffer levels have surpassed the norms by a reasonable margin as well as in large proportions. As regards fertiliser subsidy, the prevailing high global prices are a major concern, for which there is a special one-time package for additional subsidy over and above the Nutrient-Based Subsidy rates from October 2021 till March 2022.

The clarion call of the Prime Minister, inviting farmers to adopt Zero Budget Natural Farming (ZBNF), a transition away from chemical-based inputs, is significant. A fiscal impetus (probably fiscal incentives) coupled with capacity building in this area should be the next step forward. The shift to ZBNF could help in substantially lower input costs and increase yields and quality of produce along with long-term restoration of soil health. Even dedicating 1% of the current quantum of the two major subsidies would imply an inflow of about Rs 3,000 crore towards this envisaged endeavour.

As far as procurement operations by the government are concerned, diversification towards pulses and oilseeds should be encouraged, especially since buffer stocks of cereals are excess than the norm. Budgetary allocations for the procurement of pulses have risen over the years. In the case of oilseeds, India is one of the largest producer, importer and consumer — about 60% of the demand is met from imports. Boosting budgetary allocation for oilseed production under the National Food Security Mission-Oilseeds programme will help in reduction of the import bill.

Public policy practitioner Rakesh Mohan had rightly noted that the new growth areas in the agriculture sector are characterised by a higher degree of heterogeneity as compared to wheat, rice and milk in terms of multiplicity of varieties produced, regional concentration of production, marketing conditions and input requirements. Hence, there is a requirement for policy interventions to boost production and productivity in these areas which are more ‘regionally disaggregated’ and ‘knowledge-intensive’. Methods like agroforestry are important to optimise productivity, income and thereby livelihood of small and marginal farmers. Integrating agroforestry with other agricultural schemes and providing financial incentives and technical support to small and marginal farmers is the need of the hour. Upscaling of the National Mission for Horticulture and National Project on Agroforestry (introduced in 2014), with budgetary allocation of Rs 2,385 crore and Rs 34 crore, respectively (BE 2021-22), is strongly advocated.

Price stabilisation

As far as perishables are concerned, for long-term price stabilisation, the government has announced a series of measures — extension of the Operation Greens project from TOP (Tomato, Onion and Potato) to all fruits and vegetables for better price realisation of farmers; reduced wastage; affordability of products for consumers; establishing storage facilities in the PPP mode to use irradiation technology for food preservation to assist farmers. Allocation for PM Kisan Sampada Yojana, which includes Operation Greens, is Rs 700 crore for BE 2021-22. Another thrust has been given towards value addition in this sector through the production-linked incentive scheme for food processing with an outlay of Rs 10,900 crore.

The Ministry of Agriculture, Cooperation and Farmers’ Welfare was allocated Rs 1,31,531 crore in 2021-22 (BE). Of this, the major share was of the PM-KISAN scheme (49%), followed by interest subsidy for short-term credit to farmers (15%) and the crop insurance scheme (12%). A sum of Rs 8,514 crore was allocated to the Department of Agricultural Research and Education, including Rs 55 crore for the climate-resilient agriculture initiative. Simply put, incentives to shift towards ZNBF and more of pulses, oilseeds, agroforestry and horticulture cultivation and food processing activities shall, in turn, lead to transition to market-led activity and reduction in the subsidy burden, stronger linkages with the industry, boosting the value chain and leaving more room for investments in agriculture. In order to boost capital investments, the launch of the National Agriculture Infrastructure Fund with a corpus of Rs 1 lakh crore is welcome. Its implementation on a war footing is a must, besides dove-tailing with e-NAM to improve infrastructure and efficiency of spot markets.

Thus, with a high GVA-output ratio, the upcoming Budget should send out a strong signal in achieving ‘more’ from existing resources by encouraging diversification and eventually ‘more’ from ‘less’ when fruits of today’s investments shall be reaped tomorrow. Azadi ka Amrit Mahotsav should flag off agriculture as a robust engine of growth of the economy.

Asha is Deputy Director, Dept of Pharmaceuticals, and Bansal is Junior Statistical Officer, Dept of Consumer Affairs, Govt of India. Views are personal

- Reforms should make farming sustainable

WHILE Indian policy makers and economists haven’t drawn any lessons from the failure of market reforms in American agriculture, and even after the three contentious farm laws were repealed, they still reiterate that supply-demand equilibrium leads to price discovery. Market dynamics has once again failed American farmers from making a decent living.

This time, it is the turn of the livestock farmers.

Even the US President Joe Biden acknowledges the fiasco. In a statement, he said: “Fifty years ago, ranchers got 60 cents of every dollar families spent on beef. Today, they get about 39 cents. Fifty years ago, hog farmers got 48 to 50 cents for each dollar the consumer spent. Today, it is about 19 cents. And the big companies are making massive profits.” This is happening at a time when the US Department of Agriculture (USDA) estimates the beef prices to have shot up by 21 per cent, prices of pork increasing by 17 per cent and chicken prices by 8 per cent over the year.

President Biden further added: “As their profits go up, the prices in the grocery stores go up immensely; the prices farmers receive for the product they bring to markets go down.” To explain, the US Agriculture Secretary Tom Vilsack responded in a tweet, saying: “This summer, I met a farmer in Iowa who told me he lost $150 per head selling cattle to a processor who would end up making $1,800 per head.” Imagine the kind of profits meat processing companies are making while squeezing farmers’ income.

In India, we can certainly blame the profiteering arhtiyas (commission agents) and traders for exploiting farmers; the four meat processing giants controlling 85 per cent of the US meat industry are in reality the bigger middlemen, no less than big sharks. In India, there is a concerted campaign to discredit the arhtiya, building the case in turn for bringing in agri-business companies. There is certainly a need to regulate the middlemen, but the American experience shows how the consolidation of the meat industry, leading to market concentration over the years in the hands of a few big companies, is making it difficult for livestock farmers to survive. With prices crashing over the years, generations of families that reared cattle, hogs and chicken are broke, and faced with an exodus. As rural communities got wiped out, the ‘farm to fork’ experiment only ended up further expanding factory farming.

The collapse of the American farming is a living testimony to the destruction wrought by free markets in agriculture, and still worse the denial of the failure of supply-demand equilibrium in ensuring fair prices to farmers. This happened earlier with agriculture commodities, with dairy industry and now with livestock farming. Consolidation is happening across the supply chain, from farm inputs to the retail market. In fact, concentration leads to monopolisation and power, and the cartels these conglomerates form end up ruthlessly exploiting the producer as well as the consumer. Faced with the multinational corporations extracting their pound of flesh, the US National Farmers Union is running a nationwide campaign, ‘Fairness for farmers’, to break up corporate monopolies and to ensure stronger enforcement of anti-trust laws.

The US government has responded. President Biden has called for a crackdown on what some major players are doing in the economy that is keeping the prices high. To begin with, the government has allocated $1 billion for investments in small meat processing units to enable ranchers to compete with the giants in the industry. Not a perfect solution, but at least an acknowledgement of the devastation corporate monopolies inflict on both end of the supply chain — the producers as well as the consumers. The better way, however, would have been to guarantee prices to producers of agricultural commodities and livestock. Seeking income parity, this is what the massive tractor protest that took place in Washington DC in 1979 had also demanded.

Indian farmers too are demanding a guaranteed price by way of a legal sanctity to the Minimum Support Price (MSP), ensuring that no trading be allowed below the benchmark prices. Same in Europe, where farmers have been protesting time and again seeking a guaranteed fair price to bail them out of the continuing crisis.

Declining farm incomes over the past several decades has been the primary reason that led to the global farm crisis. To illustrate, in 2005, Canada’s National Farmers Union had in a detailed submission on The Farm Crisis: Its Causes and Solutions explained the reasons behind the unprecedented farm income crisis the world was witnessing for the past 20 years. Between 1985 and 2005, farm incomes had remained in the negative zone. This is exactly what the UNCTAD had also brought out in one of its studies acknowledging that farm gate prices, when adjusted for inflation, had remained static the world over in the 20-year period.

Recognising that “the farm crisis has landed with a vengeance in the highly-regulated farm economies of Europe and with equal ferocity in relatively unregulated Australia and Argentina,” the Canadian NFU lamented that the prices farmers were getting in 2005 were far less than the years of Great Depression in the 1930s. And that too at a time when the world was witnessing an impressive economic growth, a booming stocks market, growing trade and a record grain production. Among the 16-plan package it suggested as a solution to the growing crisis, guaranteeing farm incomes topped the list.

Canada’s NFU had then asked the government to implement a farm income support programme that will guarantee at least 95 per cent of farmers recover their cost of production, including reasonable returns on labour, management and investment. But like in America, the Canadian government too ignored the farmer’s legitimate call for a guaranteed price. This is essentially because the dominant economic thinking all over the world has failed to recognise the crying need to ensure farmers with a living income. As a result, farmers across the globe carry the burden of producing food at a loss.

- Diversification best bet, not price intervention

MSP is a floor price announced by the government for 23 crops (including coarse grains, pulses, oilseeds, cotton and copra) to offer remunerative prices to farmers as well as ensuring food security. While the production of rice and wheat is stabilised at sufficiently high levels, pulses and oilseeds have witnessed relatively greater price volatility. The current rhetoric for legalisation of MSP is directed towards burdening the consumer and the exchequer.

THE total foodgrain production for the crop year 2019-20 is estimated at 297.5 million tonnes (MT), including 226.73 MT of rice and wheat taken together. Of this, 99.01 MT of these two foodgrains was procured by the Union government at the Minimum Support Price (MSP) during the 2020-21 marketing season.

The MSP is a floor price announced by the government for 23 crops (also including coarse grains, pulses, oilseeds, cotton, copra and de-husked coconut) to offer remunerative prices to farmers as well as ensuring food security. While the production of rice and wheat is stabilised at sufficiently high levels, pulses and oilseeds have witnessed relatively greater price volatility. Purchases at MSP are currently only restricted to purchases by the government and modalities may vary from crop to crop due to their respective dynamics, but are primarily driven by considerations of food security.

The current rhetoric for legalisation of MSP, however, is not in the direction of greater food security, but towards burdening the consumer, the public exchequer and trade for the following reasons:

First, trade of all produce at MSP would lead to an increase in wholesale prices, cascading into retail inflation and reducing the purchasing power of consumers. In the long run, this may also lead to a shift in dietary patterns away from such crops, resulting in a self-defeating scenario. For a predominantly vegetarian population of our country, pulses and coarse grains are not only the primary source but also comparatively inexpensive source of protein. A resultant shift in dietary patterns may not be desirable in our efforts to combat malnutrition.

Second, a gradual reduction in demand may in turn crowd out trades made by small and marginal farmers with relatively larger farmers bargaining to meet supplies. More than 85% of our farmers are small and marginal. Further, more than 55% of our population is engaged in agriculture. Thus, the interests of a significant proportion of the relatively more vulnerable groups needs to be seen in the light of efficacy of policy intervention. Moreover, a rise in retail inflation would also hurt these groups in their capacity of being ‘consumers’.

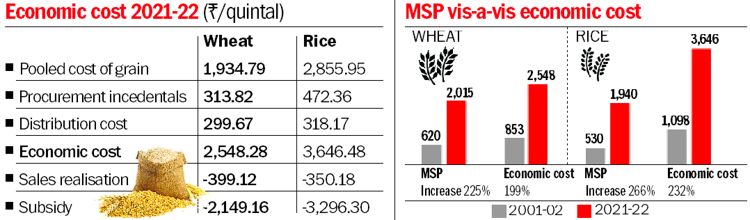

Third, the fiscal implications of MSP don’t end with the procurement cost. Maintaining large quantities of stocks involves huge carrying cost. This would spell trouble as far as fiscal prudence is concerned due to the rise in not only farmers’ subsidies but also consumer subsidies as well as carrying costs. As per data made available by the Food Corporation of India (FCI), the economic cost (that includes incidental costs and distribution costs in addition to the MSP) for wheat in 2001-02 was Rs 853/ qtl, which has increased to Rs 2,548 in 2021-22. For rice, the economic cost was Rs 1,098/qtl in 2001-02; it rose to Rs 3,646 in 2021-22. Not to forget that a considerable part of this rice and wheat is supplied at a highly subsidised Central Issue Price (CIP) of less than Rs 5/kg under various welfare schemes. For FY 2021-22, the FCI has shown sales realisation of Rs 3.99/kg for wheat and Rs 3.50/kg for rice. Therefore, the subsidy for wheat comes to Rs 2,149/qtl and for rice it is Rs 3,296 per quintal. This is the current estimation of per-quintal cost on the exchequer for the whole procurement and disposal exercise of rice and wheat.

Lastly, such a move would have adverse general equilibrium effects. It would not only increase costs of downstream users of agricultural goods, but may also raise input costs by incentivising non-competitiveness. This shall eventually aggravate non-optimal use of scarce inputs such as water and electricity and worsen environmental degradation. A high-cost economy would also hurt export competitiveness and fritter away export markets. Further, funding subsidy would entail more resources, implying an opportunity cost on investments/development-oriented interventions.

The MSP operations in a limited manner help to cater to multiple objectives of extending remunerative prices to growers and ensuring food security respecting financial constraints. The Commission for Agricultural Costs and Prices (CACP) has reiterated its stance of reviewing the open-ended procurement policy especially when it comes to the states of Punjab, Haryana and Telangana in its Report on Price Policy for Kharif Crops of 2021-22 season. The Commission has also highlighted the need to reorient policy direction to encourage ‘demand-driven sustainable crop diversification’ in favour of maize, pulses, oilseeds and horticultural crops that currently face low profitability and high risk. These state governments should come up with innovative, WTO-compliant funding and solutions to support such diversification. Taking a cue from the PAHAL scheme, relatively better-off farmers from these states could also set an example by ‘voluntarily’ letting go of subsidy on rice and wheat by diversifying to other crops.

The benefits of greater emphasis on non-price interventions are manifold. Such diversification would in turn lead to productivity gains and improve competitiveness. Further, diversification should further extend to horticulture and agroforestry, the benefits of which may be explored separately.

The NITI Aayog’s report on doubling farmers’ income has highlighted key measures which are relevant to the agricultural sector today. Farmers’ groups should now take the lead with regard to agricultural marketing reforms by making suitable provisions for private mandis, direct marketing, contract farming, e-trading, single-point levy, direct sale by consumers to farmers and single traders’ licence. The organised strength of farmers’ groups like FPOs (farmer producer organisations) should be constructively channelised to promote investments in agriculture, value chains and producers’ alliances.

Further, when it comes to increasing farmers’ income, a lot has been talked about increasing the procurement price (P), but very less is said about boosting productivity to increase the per hectare output (Q). While farmers’ income is determined by both P and Q, increasing Q will have a favourable impact on their income without much debate on policies and politics of increasing P.

Rather than legalisation of MSP, a shift should be made towards supplementing decentralisation of price stabilisation efforts as this will better cater to the diversity of nature’s endowment, size and distribution of agricultural works in the nation. These entail regional/state-level and crop-specific interventions against a one-size-fits-all approach. The choice should be of collaboration over conflict to realise Atmanirbharta.

Asha is Deputy Director, Dept of Pharmaceuticals, and Bansal is Junior Statistical Officer, Dept of Consumer Affairs, Govt of India. Views are personal

- Sustainable agricultural practice need of the hour: Former Agriculture Production Commissioner Sanjeev Hota

BHUBANESWAR: Even as the Union Budget has proposed several measures to reform and revive the agriculture sector, experts feared that the initiatives without a proper balance between profitability and sustainability may have disastrous impact on livelihood, economy and the environment.

Speaking at a policy dialogue organised by Centre for Policy, Governance and Advocacy (CPGA) here on Sunday, former Agriculture Production Commissioner Sanjeev Hota expressed concern as farmers are marginalised due to Government and corporate interventions.

“Farming is being majorly done by small and marginal farmers without any bargaining power, and they are mostly dependent on the Government for MSP. Lack of storage and transport facilities besides water scarcity and risks involved in the farming sectors make them vulnerable. There will be little utility of sustainability plans without addressing these vulnerabilities,” he pointed out.

Director of Nabakrushna Choudhury Centre for Development Studies (NCDS) Prof Srijit Mishra highlighted five unsustainable practices, including income unpredictability, difficulty in credit provision, uneven technology absorption, non-inclusive policy design and un-integrated farming, that are responsible for distress in the agriculture sector.

Describing how the Odisha Millet Mission has emerged as a best practice model in nutritional intervention, he suggested to focus on scheduled areas, scheduled people and scheduled crops for a sustainable development in the sector.

Several experts stressed on good cultivation and marketing practices in agriculture. They demanded that wholesale markets should be shifted out of cities and marketing provisions be made in municipality and panchayat markets under the supervision of State agricultural marketing board. They also suggested that surplus funds lying with different RMCs need to be transferred to the State market fund as provided under the Agricultural Produce Marketing Regulation (APMR) Act.

Agriculture researcher Natabar Sarangi expressed concern on the use of chemicals in agri-practices. Soil, mechanisation and quality seed are three important factors, he said and opined that ‘desi chasa’ (traditional farming) is the best alternative and the future of farming.

“Revival of soil fertility, use of indigenous seeds and organic manure, rainwater harvesting and organic farming are the need of the hour to arrest the impact of global warming and climate change in agri sector,” he said.

Former Finance Minister Panchanan Kanungo inaugurated the event. Chairman of CPGA Tejeswar Parida reviewed the economic survey of 2019-20 with a focus on agriculture.

- Indian Agricultural officers from seven states on Israel tour to learn new approaches and techniques

Agricultural officers from seven different states of India are on a fifteen-day tour of Israel to learn about new approaches and technologies in the sector that can add more value to the farmers.

The 18 agricultural officers from Indo-Israel Centers of Excellence (CoE) are taking part in an extensive state course, “Managing Centres of Excellence: Developing value for farmers”, organised by Mashav Agricultural Training Centre (MATC) in Israel under the Indo-Israel Agricultural Project

(IIAP), a press release said.

The programme looks to introduce the agricultural officers from partnering states to the organisation, management and challenges of Israel’s unique model of regional agricultural Research and Development.

- Govt in process of setting up committee on MSP : Narendra Singh Tomar

The government is in the process of setting up a panel on Minimum Support Price (MSP), Agriculture Minister Narendra Singh Tomar said in the Lok Sabha on Tuesday. While announcing the repeal of three farm laws in November last year, Prime Minister Narendra Modi had promised to set up a committee to make MSP system more effective and transparent as well as suggest ways to promote zero budgeting based-agriculture.

“As per the changing requirements of the country to change the cropping pattern, to make MSP more effective and transparent, and to encourage natural farming method of agriculture, setting up a committee is under process,” Tomar said in a written reply to the Lok Sabha.

On February 4, Tomar had said in the Rajya Sabha that the matter of forming the committee on MSP is under consideration of the ministry and will be formed after the assembly elections in five states namely Uttar Pradesh, Uttarakhand, Manipur, Goa and Punjab.

- Now Government plans to launch super app for farmers

The government plans to launch a super app for farmers, consolidating multiple digital entities and existing mobile applications meant for them, said an official at the ministry of agriculture and farmers‘ welfare.

The consolidation will help farmers in accessing information such as latest research and development, weather and market updates, services available, government schemes and advisories for different agro-climatic zones under one umbrella.

The ministry is looking at combining apps like Kisan Suvidha, Pusa Krishi, MKisan, Shetkari Masik Android App, Farm-o-pedia, Crop Insurance Android App, AgriMarket, Iffco Kisan and ICAR’s Krishi Gyan among others.

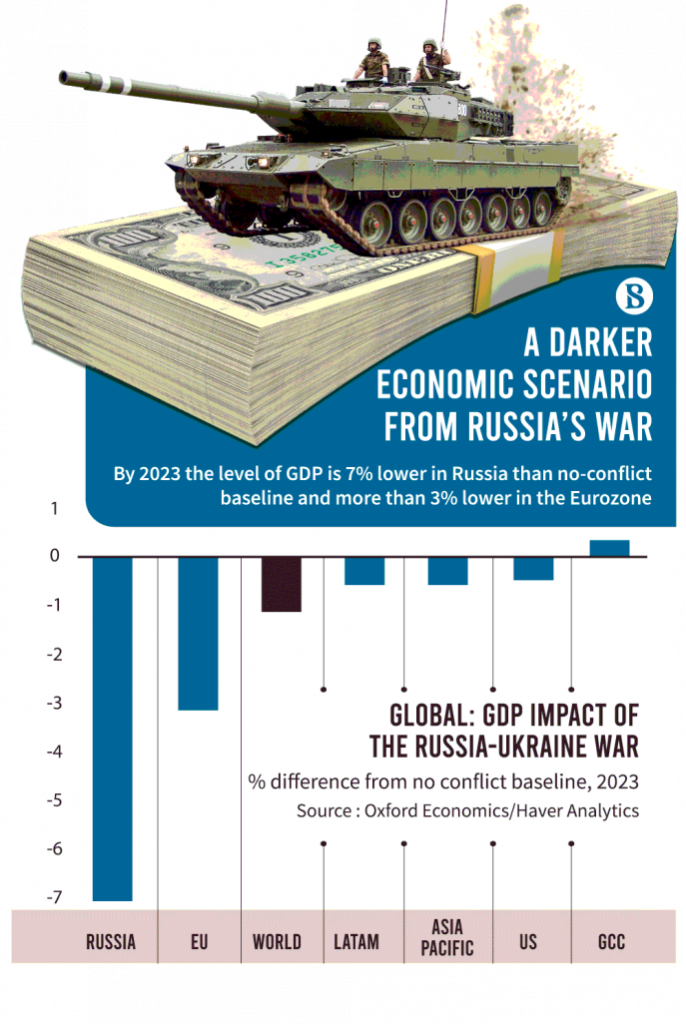

- Export Demands soars for Indian Wheat, corn, spices following Ukraine War

Export demand for Indian wheat, corn and spices has shot up after Russia launched a military operation against Ukraine, forcing the international trade of agricultural commodities to shift sourcing to India since supplies from the two nations have come to a grinding halt.

“The prices of wheat at the Kandla port have increased from ₹2,200 per quintal to ₹2,350-2,400 per quintal in the last four days. With the FCI (Food Corporation of India) declaring that its upcoming tender this week will be the last one in March, we think that the prices of wheat and wheat products may increase further in the next fortnight,” said Sanjay Puri, former president of the Roller Flour Millers Association of India. “The next crop will be harvested only after Baisakhi (April 13).”

Most of the wheat stock in India is held by the government agency FCI, which is not exporting the commodity. Wheat traders want the FCI to release more wheat into the market, which will help keep domestic prices under control, reduce excess stocks and also meet the export demand. However, the processing industry is worried. “We will be requesting the government to immediately stop export of wheat from the country as the local prices have jumped from ₹21 per kg before the outbreak of the war to ₹24 per kg today (Tuesday). The export demand is so huge that if we do not stop exports, then the prices can increase further and may also lead to shortages in future,” said Anjani Agarwal, president, Roller Flour Millers Association.

- Who will pay for the kisan drone ?

Would unmanned aerial vehicles or drones be hovering over millions of hectares of farmlands in India? Would they become as commonplace as tractors or power tillers on the ground? In her 2022 Budget speech, Finance Minister Nirmala Sitharaman highlighted the government’s resolve to promote what are being called kisan drones.

Drones have flown into India’s fields pretty fast. It was only in August 2021 that the ministry of civil aviation liberalised the drone use policy, allowing certain types of drones to fly without prior permission. Soon after, the Department of Agriculture and Farmers’ Welfare published the standard operating procedure (SOP) for the use of drones in spraying pesticides in agricultural, forestry and non-cropped areas.

The government is pushing for a massive use of drones in agriculture across India. It wants drones to be yet another agricultural equipment like power tillers, manure spreaders, trolley pumps, sprayer pumps, et al. But who will pay for the drone service? Will end users, meaning farmers, have to bear the entire cost? Or, will the government chip in?

The department of agriculture estimates that the service of a drone that has the capacity to carry a 10 kg payload will cost Rs 350-450 per acre. The calculation is based on the assumption that a drone equipped with multiple batteries will be utilised for at least six hours a day, covering about 30 acres of farmland. The cost of operation could vary, depending on the type of crop and topography.

Delhi-based company Matrix Geo Solutions, which has 15 drones, has been providing services since 2014. Its cofounder Amit Sharma says, so far, only two of its trips have been connected to agriculture — for an assessment of sugarcane crop in UP and to fight the locust attack of 2020. He says it makes economic sense for a drone company to visit a farm, provided it gets an order for Rs 12,000-15,000 a day.

MADE IN INDIA

Ashutosh Sharma, former secretary in the Department of Science and Technology (DST) and professor at IIT-Kanpur, says that once the sector opens up, the price of Indian drones will fall drastically. “Once there is demand, more and more Indian companies will manufacture drones. Indian drones will be cheaper than imported ones. Drone-making is a simple technology,” he says.

SK Pattanayak, former Union agriculture secretary, says kisan drones will have three functions to begin with. “First, drones will be used for crop assessment. That will help in early settlement of insurance claims. Second, it will be deployed for the digitisation of land records. For both these tasks, the government will pay for the services. The third function is spraying, for which farmers will pay,” he says, adding that in future the device could be used for monitoring the moisture content in the crops as well as for controlling epidemics.

The DST had earlier experimented with a pilot project by using drones with hyper spectral sensors to receive information on the health of soil and crops, water content, nutrients, et al. Sharma bets on the proliferation of drones in the hinterland, saying the phenomenon will be comparable to STD booths of another era. “If a farmer gains by using a drone, she will be willing to pay for it. To my mind, drone services in rural areas will be like STD booths of yesteryear. It will stimulate entrepreneurship. Farmers won’t own drones, they will hire them,” he says.

Union Budget 2022 : Rs. 2.37 Lakh Cr for MSP, tech usage and chemical free farming for agri sector

- Fertilizer prices surge in signal of worsening food inflation

Fertilizer prices continue to surge as supply upheaval from Russia leaves governments struggling to secure vital crop nutrients, adding to concerns that record global food inflation will accelerate.

The Green Markets North American Fertilizer Index jumped 16% Friday to a new high. Prices for the widely used nutrient urea in New Orleans soared 22%, also reaching a record. And an index for potash in Brazil rocketed a record 34%.

Russia is a huge low-cost exporter of every major kind of crop nutrient. The country urged domestic fertilizer producers to reduce exports earlier this month, stoking fears of shortages. The war also is pushing up the cost of natural gas, the main input for most nitrogen fertilizer, forcing some producers in Europe to cut output.